Global S&T Development Trend Analysis Platform of Resources and Environment

| Strong fundamentals could give gold price new leg up | |

| admin | |

| 2019-08-01 | |

| 发布年 | 2019 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

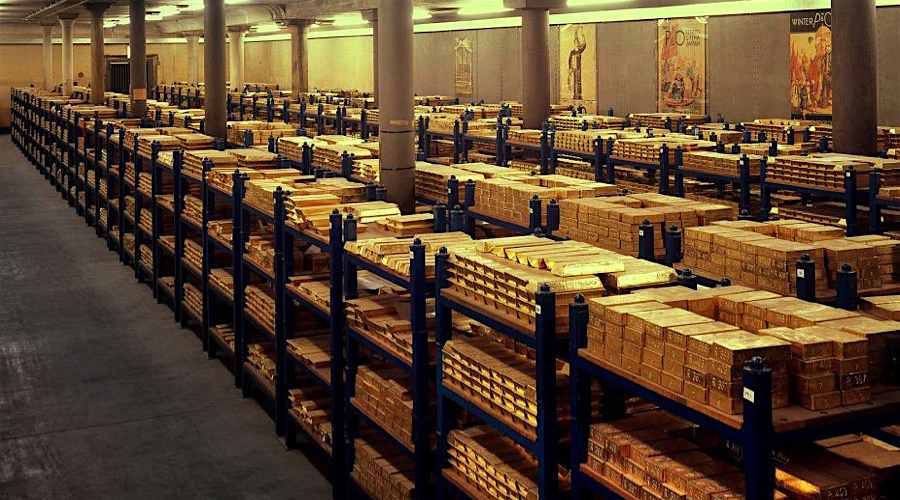

| 正文(英文) |  Bank of England gold vault. (Image from archives)

Since the more than $100 rally over three weeks in June, gold has been trading sideways and remains stuck between $1,420 and $1,440 an ounce. While gold traders and futures speculators may be taking a breather, a new report shows strong fundamentals underpinning the gold market could provide the basis for a new leg up in the price. The World Gold Council demand trends report to end-June measures an 8% year-on-year increase for Q2 2019 to 1,123 tonnes and a three-year high of 2,181.7 tonnes for the first half of the year. Central bank buying and healthy ETF inflows were the driving forces behind stronger gold demand, according to the WGC, with the only negative so far this year being a drop in bar and coin investment, particularly in China. Gold shines throughApart from official sector and ETF buying, highlights from the report include strong Indian jewellery buying and a primary production of gold setting a quarterly record: Central banks bought 224.4t of gold in Q2 2019. This took H1 buying to 374.1t – the largest net H1 increase in global gold reserves in our 19-year quarterly data series. Buying was again spread across a diverse range of – largely emerging market – countries. Holdings of gold-backed ETFs grew 67.2t in Q2 to a six-year high of 2,548t. The main factors driving inflows into the sector were continued geopolitical instability, expectation of lower interest rates, and the rallying gold price in June. A strong recovery in India’s jewellery market pushed demand in Q2 up 12% to 168.8t. A busy wedding season and healthy festival sales boosted demand, before the June price rise brought it to a virtual standstill. Indian demand drove global jewellery demand 2% higher y-o-y to 531.7t. Bar and coin investment in Q2 sank 12% to 218.6t. Combined with the soft Q1 number, the H1 total ended at a ten-year low of 476.9t. A 29% y-o-y drop in China accounted for much of the global Q2 decline. Gold supply grew 6% in Q2 to 1,186.7t. A record 882.6t for Q2 gold mine production and a 9% jump in recycling to 314.6t – boosted by the sharp June gold price rally – led the growth in supply. H1 supply reached 2,323.9t – the highest since 2016. |

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/219617 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. Strong fundamentals could give gold price new leg up. 2019. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论