Global S&T Development Trend Analysis Platform of Resources and Environment

| Mining deal value down over $18bn due to pandemic | |

| admin | |

| 2020-09-08 | |

| 发布年 | 2020 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

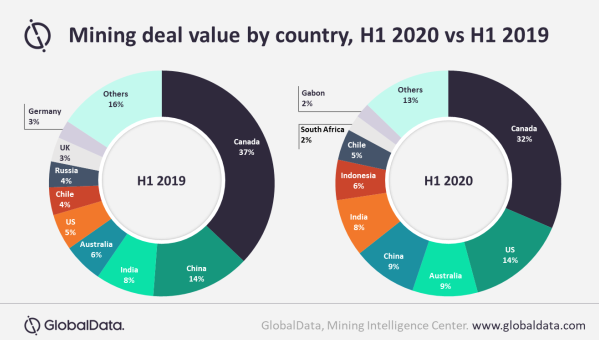

| 正文(英文) |  Global mining deal value, suffering from an unanticipated shock from the covid-19 pandemic, fell by over $18 billion when compared to the first half of 2019 to $46.6 billion in the first half of 2020, GlobalData reports. The global economic slump, steered by a series of challenges, has kept investors away from long-term financial instruments, resulting in a 12.7% y-o-y fall in the capital raised by mining companies, according to GlobalData. Mining mergers and acquisitions (M&As), despite a decent first quarter owing to deals involving gold, fell by 51.6% during the first half of 2020. Overall, GlobalData says the majority of the impact was evident on the completion rate, as there was a 41.7% y-o-y fall in the completed deal value.  Seven of the top ten asset transactions deals involved gold, GlobalData reports. Topping the list was Mudrick Capital Acquisition Corporation (MUDS), which acquired an equity interest and assets from Hycroft Mining Corporation for a consideration of $537m to form Hycroft Mining Holding Corporation. The remaining three involved cobalt, coal and copper. “The largest of the completed deals was the acquisition of Detour Gold by Kirkland Lake Gold Ltd for $3.79bn,” says Vinneth Bajaj, senior mining analyst at GlobalData.

“By including the Detour Lake mine to its production assets, the company aims to produce up to 1.5moz of gold in 2020. With this acquisition, Kirkland also added $173.9m in cash and repaid Detour’s debt of around $98.6m, adds Bajaj. “With strong liquidity, the company is well-positioned to cope with covid-19 challenges. Kirkland also raised $1m in a private placement of shares primarily to complete phase 2 permitting of its Hasbrouck project in the US.” PT Indonesia Asahan Aluminium’s raised $2.5bn by offering three sets of bonds at 4.75% (due in 2025), 5.45% (due in 2030) and 5.8% (due in 2050). Of the total, 60% will be used to pay debts and to acquire 20% of PT Vale Indonesia, while the remaining 40% will be used to refinance the company’s older bonds. Freeport-McMoRan raised a collective $1.3bn, which will be used to fund its purchase of certain outstanding senior notes due in 2021 and 2022. “The total volume of deals increased from 1,811 in H1 2019 to 2,271 in H1 2020 owing to a 79.7% increase in the total number of announced capital raising deals in that period. This was accompanied by a 28.4% increase in the volume of completed M&A deals, Bajaj says. “Canada, US, Australia, China and India accounted for nearly 87% of the total deal volume and over 72% of the total deal value.”

|

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/293521 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. Mining deal value down over $18bn due to pandemic. 2020. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论