Global S&T Development Trend Analysis Platform of Resources and Environment

| Nickel market caught up in fresh squeeze | |

| admin | |

| 2022-01-18 | |

| 发布年 | 2022 |

| 语种 | 英语 |

| 国家 | 国际 |

| 领域 | 地球科学 |

| 正文(英文) | Electric cars. (Image by Joe A. Kunzler Photo, Flickr).

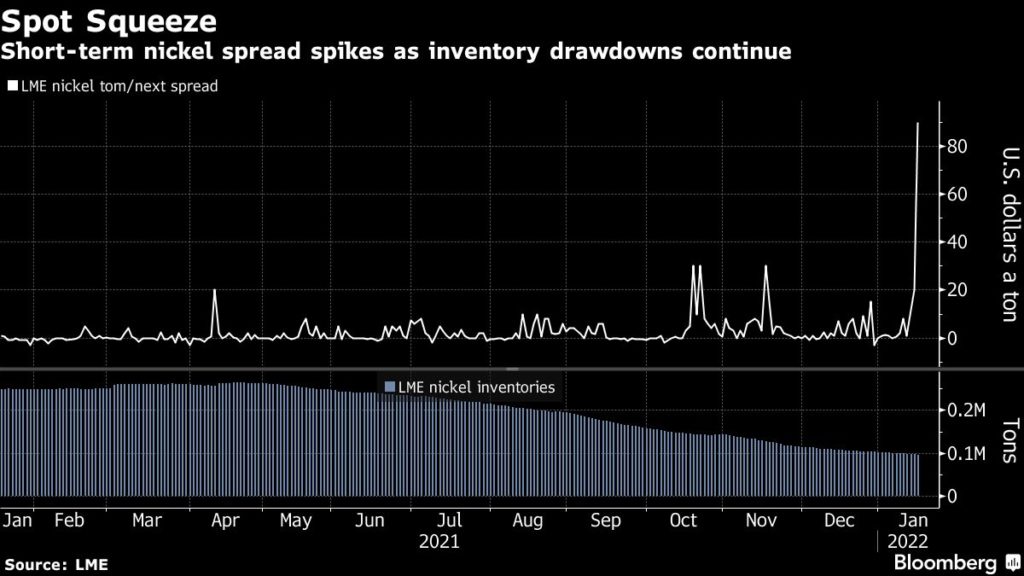

Nickel’s biggest supply squeeze in more than a decade is drawing attention from the London Metal Exchange, as plunging inventories mean buyers are forced to pay massive premiums for immediately available metal. Cash contracts on the LME reached a $90-a-tonne premium to those expiring a day later, the highest since 2010 and nearing levels seen in 2007 during a historic squeeze. The bourse has stepped up its monitoring of the nickel market in response, and may take further measures to ensure orderly trading if needed, a spokeswoman said by email. The turmoil in nickel is the latest example of acute supply stress in global metals markets, and represents the third time in 12 months that the LME has stepped in to increase monitoring. Both copper and tin have seen wild price moves in recent months after exchange stockpiles shrank dramatically, sparked by surging demand and supply bottlenecks during the pandemic. For copper, the LME was forced to take rare steps to restore order, including placing limits on the nearest-term spreads for the metal and allowing holders of some short positions to avoid delivery.  The last time nickel inventories tracked by the LME reached current critically low levels was in 2019, when the bourse launched a market-conduct inquiry after top stainless steelmaker Tsingshan Holding Group Co. sparked controversy by withdrawing large amounts of stocks. The premiums for spot contracts now are even steeper, suggesting the strain on buyers is more acute this time around. [Click here for an interactive chart of nickel prices] Stockpiles have also fallen on the Shanghai Futures Exchange, leaving buyers exposed to a simultaneous squeeze in onshore and international markets, and helping to keep prices near the highest since 2011. The surge in premiums for near-term supplies has come to a head as traders and industrial consumers rush to buy back short positions in monthly contracts that are coming due on Wednesday. Stronger demand for nickel in electric-vehicle batteries and fresh worries about supply from Indonesia have caught many in the market off guard. “The Shanghai tightness has fed through to London now, with low stocks on both exchanges and no signs of deliveries yet,” Marex analyst Alastair Munro said by email.

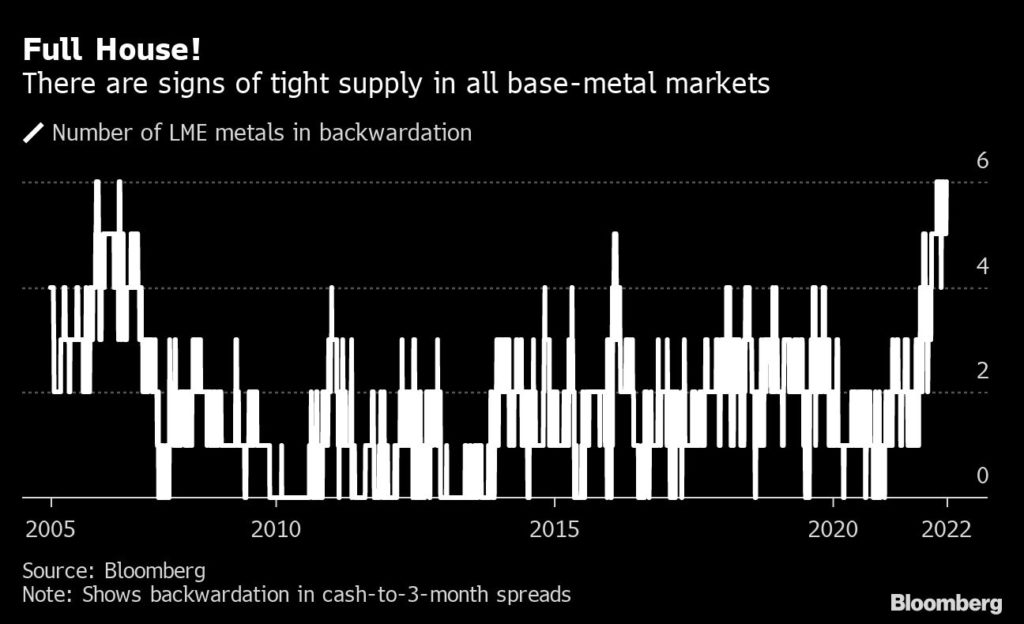

Nickel for delivery in three months on the LME was little changed at $22,075 a ton at 3:35 p.m. in London, after earlier rallying toward a peak set last week. In other metals, tin jumped as much as 2.3% reaching a record-high amid a chronic shortage that’s been exacerbated by global logistics snarl-ups. All metals traded in backwardation on the LME, in a rare bout of synchronized tightness. Metals could find support after economists forecast that China’s cut of two key policy interest rates has opened the door to more monetary easing actions ahead. The country’s economy is being tested by outbreaks of the omicron virus strain, a decelerating property sector and sluggish consumer sentiment. (By Mark Burton, with assistance from Winnie Zhu and Yvonne Yue Li) |

| URL | 查看原文 |

| 来源平台 | Minging.com |

| 文献类型 | 新闻 |

| 条目标识符 | http://119.78.100.173/C666/handle/2XK7JSWQ/344564 |

| 专题 | 地球科学 |

| 推荐引用方式 GB/T 7714 | admin. Nickel market caught up in fresh squeeze. 2022. |

| 条目包含的文件 | 条目无相关文件。 | |||||

| 个性服务 |

| 推荐该条目 |

| 保存到收藏夹 |

| 查看访问统计 |

| 导出为Endnote文件 |

| 谷歌学术 |

| 谷歌学术中相似的文章 |

| [admin]的文章 |

| 百度学术 |

| 百度学术中相似的文章 |

| [admin]的文章 |

| 必应学术 |

| 必应学术中相似的文章 |

| [admin]的文章 |

| 相关权益政策 |

| 暂无数据 |

| 收藏/分享 |

除非特别说明,本系统中所有内容都受版权保护,并保留所有权利。

修改评论